On April 18, 2008, my father passed away from cancer. While it’s a sad day, I always strive to make each day better than the last. I know that’s what he would have wanted, and I would like to dedicate today’s post to him. I’ve written this post before, but I have updated it for…

On April 18, 2008, my father passed away from cancer. While it’s a sad day, I always strive to make each day better than the last. I know that’s what he would have wanted, and I would like to dedicate today’s post to him. I’ve written this post before, but I have updated it for this year, and it still makes me very happy when I read it. Enjoy!

On April 18, 2008, my father passed away from cancer. While it’s a sad day, I always strive to make each day better than the last. I know that’s what he would have wanted, and I would like to dedicate today’s post to him. I’ve written this post before, but I have updated it for this year, and it still makes me very happy when I read it. Enjoy!

My dad was a huge part of my life, and it only makes sense to talk about him today. This is especially true because he taught me so many important financial lessons that I think about all the time.

If it weren’t for my dad, I would probably be, at least, a little worse with money.

Due to this, I believe that teaching your children valuable financial lessons is key. This will help them grow up and be better able to manage a budget, understand investing, know how to save money, and more.

Below are some of the many great financial lessons my father taught me.

He taught me that I could afford to travel.

One of the biggest financial lessons my father taught me was that I can afford to travel.

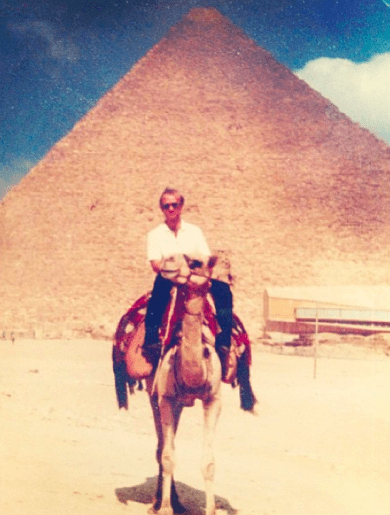

My dad traveled all over the world. Besides his family, the other things he loved in life were traveling and airplanes (he had his pilot’s license and worked for the airlines nearly his whole life). He always made sure to fit traveling into his life in any way he could, and I gained many great memories from it.

I still remember him taking me to Disney World ALL THE TIME (I loved it!), flying in small planes with him, and even having a great time just sitting at the airport. He loved every single part of traveling.

He created hundreds of photo albums from his travels, which I still look at on a regular basis. I also recently found a travel journal he kept that listed all of the amazing places he traveled to.

If you are thinking my dad was rich, he wasn’t. Instead, he worked with his budget and always made sure to fit exciting trips in because that is what he believed in.

For example, he bought a new Camaro in 1984 (this was his baby), and he drove it up until a few months before he passed away in 2008. He didn’t care about furniture, electronics, or anything else. He would often work long hours, he hardly ever called off work, he always had a budget, he always saved money, and more.

He was all about travel, and he managed his money well so that he could take trips whenever he could.

He taught me not to live paycheck to paycheck.

My dad was all about having a budget. He went over his budget and his checkbook nearly every single day. Working for the airlines meant that he occasionally got laid off and rehired over and over again.

Due to this, he always made sure to budget his money well.

He always had an emergency fund, he always made sure he spent less money than he made, and he always made sure to put as much money as he could towards retirement.

My dad did anything and everything to make sure that we didn’t have to worry about money or go without anything that we needed when we were kids. It’s a trait of his that I loved. Even when he would get laid off, he never acted like it was a big deal because he was always prepared.

He taught me that credit can be used to my advantage.

The topic of credit cards and credit came up a lot when I was younger.

I remember one day my dad was complaining about what I thought was a scammy credit card commercial. I was super young and said, “I’m never going to have a credit card!”

My dad then told me that if I used them correctly, credit cards could be used to my advantage. Even though I was young, he then explained how to use credit cards, and I now use credit cards on a regular basis to earn awesome rewards and bonuses.

Thanks Dad for another great money lesson!

He taught me that money doesn’t have to limit you.

Out of all of the money lessons he taught me, this last one is probably the most important.

Even though my dad passed away too young, lived on a budget, and saved for a retirement that he never got to experience, I truly believe that he still lived the life he wanted to live.

He was still able to travel all over the world and visited many, many countries. I’m not sure how many countries he visited but I know it was well over 50.

I think the most important money lesson I learned from my father is that money doesn’t have to control you. Even though you will never know when your last day is, you can still save and spend your money wisely, while also living the life you want.

Too many people believe that they can’t lead a good life on a budget. That is not true at all. You can still live a great life while managing your money, and without regret.

What financial lessons did your parents teach you? What financial lessons will you make sure you teach your children?