Today, I have a great guest post to share. Here is how this person paid off $65,000 in student loans all while investing at the same time. Student loans… everyone’s got ‘em everyone wants to get rid of them. This is a story of my battle with student loans and how I found success in…

Today, I have a great guest post to share. Here is how this person paid off $65,000 in student loans all while investing at the same time.

Student loans… everyone’s got ‘em everyone wants to get rid of them. This is a story of my battle with student loans and how I found success in the middle of a vicious cycle of urgency to invest, save for a house and pay off debt.

My background on student loans

I went to a fairly large out of state school, which resulted in a huuuuge annual tuition payment along with room and board, food, annual travel expenses, etc. I had to pay for it somehow. Just like everyone else I had to revert to student loans… For all four years. Yikes.

But, that wasn’t all of it. Student loans only covered tuition expenses. I had to work part-time while going through college because I had to pay for food, rent, living expenses and more. Solely on my own. This ended up being a blessing in disguise as I graduated without any credit card debt.

As a finance major throughout college, I always had this fascination with personal finance. I read it during my spare time and always seemed intrigued about how I could better myself for the future.

Upon graduation, I found an extreme urgency to: 1) find a career that was finance related, and 2) use that job to improve my financial future.

This urgency for financial planning lead me to create a wealth strategy roadmap that I could follow, These wealth creation tips would enable me to:

- Invest;

- Get rid of student loans; and

- Save for a house.

I knew I wanted to accomplish all of these at the same time. By creating my financial roadmap, I realized I had to make a lot of sacrifices.

A sense of urgency to pay off student loans, invest AND save for a house

By graduating with a finance major in college, I developed this sense for ‘money optimization’ combined with traditional personal finance thinking.

I incorporated a different approach to student loan repayment because I wanted to invest and save along the way.

Here was my exact roadmap for how I accomplished all three.

Step One: Bite the Bullet Early with Investing

Right out of the gate from college, I knew that if I needed to take advantage of the benefits of compound interest and free money such as my 401k match from my employer.

I bit the bullet early. I made the max amount of contributions to my 401k as possible (the full $17,000, which was the max at the time!). Combined with that I made it a point to max out my Roth IRA, which was $5,000 at the time.

Ouch! That hurt initially. My eventual take home pay was basically nothing. I had to scrape by for food while managing rent payments.

However, while it hurt initially. This was one of the greatest things that I have done for my personal financial planning.

I had this sense of confidence that if I bit the bullet early, I would be in great shape. My income will only increase over time (as long as I focus on my career).

I did just that though. While I was at work, I stayed late and got in early. I aimed for early promotions.

I love the upside with investing. My strategy with my 401k and Roth IRA accounts includes investing in low-cost index funds to ensure I’m not eroding too much of my retirement gains on fees.

Investing was my top priority because unlike debt it has unlimited upside (it doesn’t go to 0) and I had a long runway for capital appreciation.

Step Two: Quantify My Student Loans

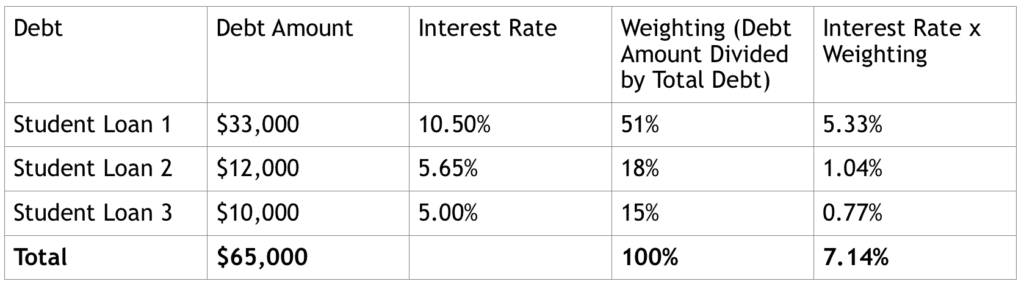

My second step in my debt repayment strategy was to create a table of the weighted average cost of debt.

Nearly all of the personal finance influencers I followed told me that debt is bad. Get rid of all of the debt you have. Immediately.

I took a slightly different approach. I wanted to get rid of all debt that was at a higher interest rate than the long-term average of the returns of the stock market and/or real estate.

Why would I contribute $1 to something that is lower returning, goes to 0 and has no upside? I would rather put that $1 into something that hits on the opposite.

Here is what my student loans situation looked like out of college when I put together my weighted average cost of debt:

Yes, I found out right when I graduated that I had a private loan that had an interest rate of 10.50%! I couldn’t believe it. I was appalled. This loan was actually accruing interest while I was in school. I since have refinanced that student loan.

In this weight average cost of debt scenario, you should pay off the highest interest rate debt first until you reach a threshold below the after-tax returns of the stock market.

The stock market has returned 7%-9% historically on a pre-tax basis, which is conservatively estimated at 4.2%-5.4% on an after-tax basis. This can be much higher as I conservatively assumed a 40% tax rate.

With that being said, I would want to repay any form of debt that is higher than 4.2%-5.4% interest rate. I ended up doing just that.

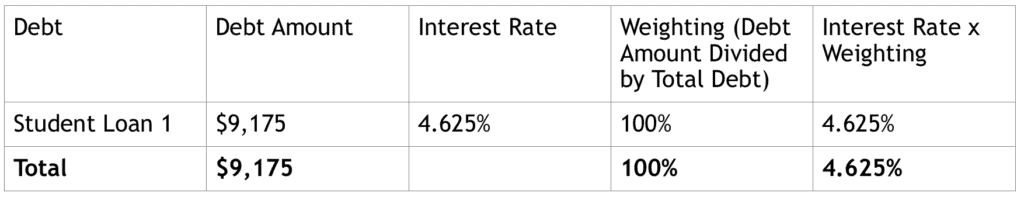

Here is a snapshot of my current student loans picture. I actually ended up refinancing my ‘Student Loan 1’ to 4.625% interest. I think I could refinance it again with a lower rate. I might end up doing that.

These are the types of personal financial ratios that I love to follow to determine my appropriate financial situation. The numbers never lie.

Any extra income you have should be swept to repay debt with interest rates higher than 4.2%-5.4%. Luckily, I had the extra income to be able to do so.

Step 3: Use Side Hustle Income to Fill the Basket Elsewhere

Once I hit below the threshold of 5.4% interest rate, I turned my attention to filling up my other financial goals. For me it wa

s buying a house. However, these goals could include investing more to live off dividends forever (a newfound goal of mine) or index investing.

However, I was a bit tapped out from my urgency to repay student loans. If you want to invest, but don’t have any money what do you do? You go out and make more money.

I found a few side hustles to increase my income, which included freelance consulting, graphic design and selling photography. This was great because this enabled me to bifurcate my work savings goals and my side hustle income savings goals.

I love side hustles as they feature so many benefits outside of the income component:

- Side Hustles Create Relationships

- Side Hustles Diversify Your Income

- You Can Use Side Hustles to Accelerate Your Personal Finance Goals and Unlock Financial Flexibility

- By Using Side Hustles, You Learn Every Single Day

You can’t have side hustle income to solely just go out and spend it. I created separate accounts to pour all side hustle income into in order to hit my goal of purchasing a house.

This was relentless and took a lot of discipline, but it is achievable. I suggest you focus on 3-4 side hustles and get very good at them. Be passionate and don’t stop working.

In order to make all three objectives work, you need to sacrifice weekend parties for ‘armchair parties.’

Fast forward four years from graduation, and through these side hustles, I was able to purchase my first home.

Lessons learned from repaying student loans and buying two houses

There are so many key takeaways from this journey of being -$65,000 of net worth to a $500,000 net worth. Let me touch on a few that will help my plan become a reality for you:

1. Debt is not the devil

There are instances in which debt can be good. Let’s go back to my house purchase. If I would have focused on repaying my 4.625% debt off completely early, I may not have been able to purchase my first home. Thanks to the recent runup in housing prices, I was able to sell my condo 3.5 years later. This resulted in a 3x return on my original downpayment. I was able to roll this into my first single-family home purchase.

Due to savings along the way while I was living in my condo, I am now turning my attention to buying an investment property incrementally to my recent single-family home purchase.

Leverage is good in the right situations. As a private equity investor in my current role, we use debt all the time on our investments. When used appropriately, debt increases your investment returns.

So, be strategic with your debt practices. If you diversify enough, debt can do wonders. Especially when tied to income producing and appreciating assets.

2. Flexibility is key, but stick to the plan

Be flexible with your personal financial plan. It is okay to focus on several things at once. However, proper planning upfront pays off big time. If you can maintain the steps along your plan, you will unlock significant value as you overperform your plan.

Remember to diversify your income streams. Not all of them will increase over time, so you need to ensure that you have proper protection in case of a downside situation.

3. Start early, work harder

For the younger generations, you need to work as hard as possible and start as early as possible. Make your desk an income producing machine by staying to 11 pm certain nights. Turn your desk into a side hustle project by working on projects after work hours. Invest in yourself by buying a laptop that you can take everyone and work on anything at any given moment.

My favorite types of side hustles are the following:

- Side hustles that rely on no-to-limited equipment

- Side hustles that can be performed anywhere

- Side hustles that are scalable

Work on side hustles, but don’t lose focus on your career. Your career can take you a very long way in your financial freedom goals.

4. Find what inspires you

For me, I was inspired by finding an answer to a problem. I was also inspired by the fact that I could achieve a number of things at once if I wanted to… I was able to create my own plan. One little trick that helped me was to print out several quotes about financial freedom and keep them in my wallet.

If you are feeling down, take a read through your favorite financial freedom quotes. These will help you look at the bigger picture and follow the process.

Here is one of my favorites for you to take with you.

“Money speaks one language… If you save me today, I’ll save you tomorrow.”

Your goals are achievable no matter the situation. Remember that personal finance is all relative to your financial situation. It is called personal finance for a reason. Stick to a plan that you are most comfortable with. Only you know your risk tolerance the best.

What will you do to repay your student loans and achieve financial freedom? Please let me know in the comments below. I’d love to hear from you.

Author Bio: Millionaire Mob is where people come together to find the best travel deals and financial advice. We specialize in dividend growth investing, passive income and travel hacking. Our advice has helped others travel the world and achieve financial freedom. Follow me on Instagram or Twitter.