Today, I have a great debt payoff story to share from a reader, Samantha Brandon. This is how her family paid off $70,000 in debt in 7 months. Like everyone else, the pandemic made us take a pause and reassess our lives. We were lucky. We had great jobs making respectable salaries (I’m a pharmacist…

Today, I have a great debt payoff story to share from a reader, Samantha Brandon. This is how her family paid off $70,000 in debt in 7 months.

Like everyone else, the pandemic made us take a pause and reassess our lives.

We were lucky. We had great jobs making respectable salaries (I’m a pharmacist and my husband is a maintenance manager). We were so lucky to have purchased a home at the end of 2019 RIGHT before the market hike.

Yet, we were living paycheck to paycheck.

And I know what some of you may be thinking. How can you make six figure salaries and still be living paycheck to paycheck?

Easy. It’s called daycare for two children, student loans, and some miscellaneous debt living in a sunbelt city where living costs suddenly exploded.

And sorry, but no. I’m not moving to another city with a low cost of living, away from all of my family and friends to save money.

So, there we were. Six figure incomes but living paycheck to paycheck despite having a 15 year-old truck, 7-year-old Nissan Murano, a home WELL below our “means”, but still broke.

I’m a firm believer in taking control of your future, so we made some drastic decisions and got to work.

Related content:

The Real Steps We Took To Pay off Debt

1. We Devoted an Entire Day to Future Planning

Ahhh, the financial day. If you’re a parent then you know, you can’t get anything done with toddlers running around.

So we knew if we wanted to take this seriously, we would need a solid six hours of uninterrupted parent-only time to sort out our finances.

Here’s what we needed:

- Wonderful in-laws to watch the kids for an afternoon

- A laptop with Google Sheets ready to rock and roll.

- Two cell phones with all bank accounts up and ready.

- My trusty TI-89 that hadn’t been used since high school

- Beer. This helped take the edge off when we really didn’t want to face our financial reality.

Sure, there are a lot of apps that can do this dirty work for you, but there’s just something different about doing it manually.

Reading through EVERY SINGLE purchase you made out loud makes a huge difference.

2. Creating Your “Cost of Living” Spreadsheet

To get an accurate cost of how much we spent per month, we looked at all of our bank accounts and credit cards over the last 3 previous months for an accurate picture.

So we started with two Excel sheets:

- The main “Cost of Living” sheet

- and then our “Spending Habits” sheet

We had both opened and started going through the last three months of costs.

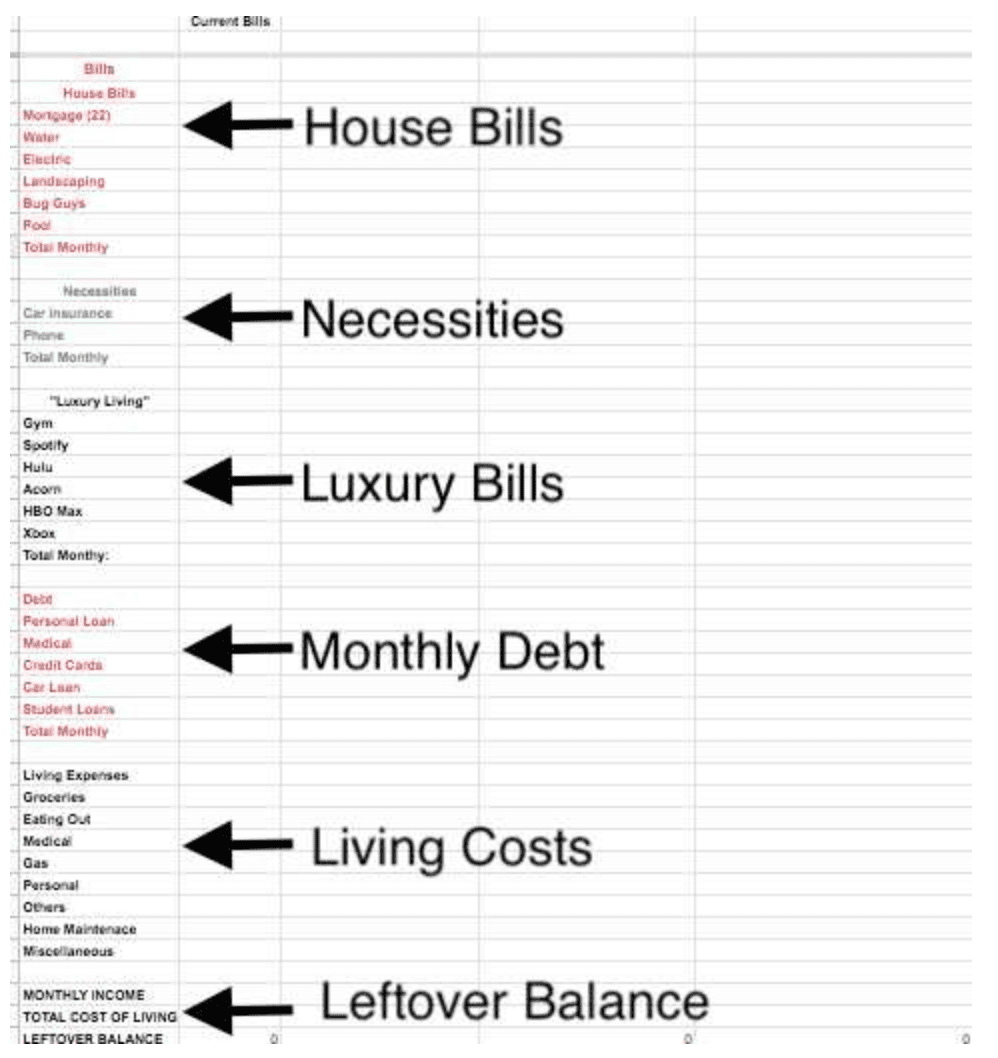

Step 1: Fixed Costs on the “Cost of Living” Sheet

As we went through our accounts in chronological order, we would enter all “fixed” bills similar to below. We already had a “budget” sheet we used, but it was good to make sure we had the amounts accurate. To our surprise, we saw some bills like car insurance had changed since we last checked.

You can break things down however you want, but we had home costs, necessities, and luxury fixed costs.

One of the biggest things we found is we were paying subscriptions we didn’t even remember we had. We wrote these down in a separate area to cancel later.

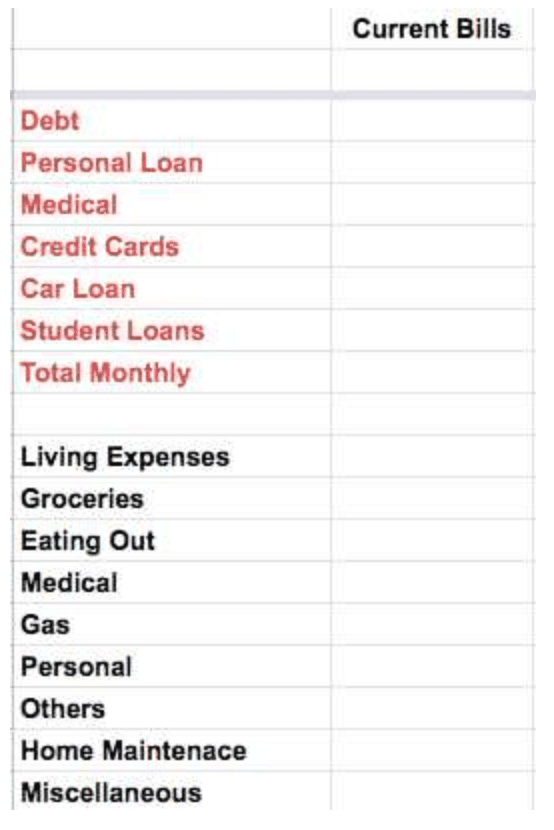

Step 2: Figure Out Your Spending Costs on the “Spending Cost” Excel Sheet

The next thing we needed to tackle was “Spending Costs”. Normally, we guesstimate for food, shopping, and other living expenses. But the goal of this was to get a real, honest figure on our spending habits. So we went through our two bank accounts, one credit card, and our Amazon account over the last three months and wrote them all down.

You can add different categories than we did, but we kept it to groceries, eating out, kids, home, medical, personal, others (birthday parties, gifts, etc), and then a miscellaneous for catch-all expenses.

Again, don’t forget that Amazon account! We could have just added up how much we spent per month, but it’s much better to see what you purchased and divide it up in a way that’s appropriate. We realized we were overspending on things we really didn’t need.

When we finished, we totaled it all up, divided it by three, and had an accurate monthly spending cost. Now, this is where that first adult beverage comes in, because we were pretty shocked. And we aren’t high spenders, life just seemed to be so expensive! We felt like we were horrible at self-care wearing the same clothes from five years ago, we don’t own luxury cars, or eat at five star restaurants. But our monthly spending was so high.

My husband and I definitely ate out more than we should have, but maybe twice a week. We had two date nights a month, but each time we would easily spend $200-300 when you factor in babysitters and ubers. We felt we were living as frugally as we could, but still were spending around $2000-$3000 a month on living expenses.

Step 3: Add the Spending Habits Figures to the Cost of Living Sheet.

After taking a much needed lunch break, we took the numbers from the “Spending Habits” sheet and transferred them to the “Cost of Living” sheet.

Lastly, we added in debts such as student loans, car loans, medical loans, etc. The reason we put these together in one section, was because these were the figures that we could hopefully eliminate altogether from our budget in the future.

Step 4: Looking at the Final Picture

So, here is what the final “Cost of Living” Excel Sheet

It’s during this time, that we realized we had NO leftover balance. Actually we were negative about $100 a month which meant we were spending more than we were bringing in. We knew that this was not a long term solution to meet our goals, and before we could possibly talk about increasing investments, ROTHs, or real estate, we had to conquer our debt quickly.

UPDATE: I forgot to include daycare as a necessity budget. At $2500 a month, that was a HUGE hit for us.

3. Add up Your Total Debt

Okay, I won’t provide a picture breakdown of this, but basically just add up every single debt you have and write down their interest rate.

Here’s what ours looked like:

- Personal Loan: $40,000 renovation loan (We bought a home very under-value, but the entire home needed to be remodeled. We did it all ourselves, but after replacing all the flooring, every bathroom redone, all painting, and basics like irrigation, we spent about $40,000. Money well worth it as now the home is worth double what be bought it for).

- Vehicles: $12,000 leftover on my Nissan Murano.

- Credit Cards: $18,000 on credit cards. This probably seems like a lot, but honestly this always fluctuated.

So, our total debt was about $70,000 not including mortgage and student loans. We didn’t include those because they’re on long-term payment plans.

Now, adding up our debt wasn’t the eye opener. It was the fact that we were living paycheck to paycheck and were not making a dent in paying off the debt with the exception of minimum payments.

4. Create a Multi-Scenario Debt Pay-Off Plan

So, now it was time to figure out, how can we pay this $70,000 off?

We took that “Cost of Living” spreadsheet, and created multiple scenarios and played around with the numbers.

This part of the debt pay-off plan is the most important part of the process.

We knew we weren’t doing fantastic, but we really didn’t have a great understanding of how long it would take to pay off the debt until the numbers were right there in front of us.

It was then that we realized if we kept going down the road we were on, we would NEVER get ahead, be EASILY in our 40s with no savings other than our 401k’s. So we came up with multiple options.

Option 1: Living Frugally

We first looked at “skimping” aka getting rid of all the luxury bills, lowering our spending habits, and REALLY living frugally.

But in the end, it WOULDN’T BE WORTH IT.

Doing so would have saved us $1000 to $2000 a month, but that would still take us about 4-5 years to pay off the debt. I knew there was no way I could live like that for 5 years during the prime of our lives. Not to mention, taking this much time took away from time we could invest.

Option 2: Renting Out Our Home & Downsizing

Next, we looked at renting out the house for income, and getting a small apartment with very minimal expenses. This added maybe $1000 more a month when you added up the expenses, storage costs of all our furniture, etc. It cut our debt pay-off time to maybe 3 years. Not worth it for us.

Option 3: Moving in With My Parents

Then we looked at moving in with my parents. This cut down a lot of living costs, but still would take about two years to pay off the debt. The bonus of this option is we could have the convenience of living in the city, next to all our friends and family. Our lifestyle wouldn’t change too badly and we could still enjoy life. But as my parents worked, we would still need to send my kids to daycare which was a $2500 monthly bill.

Option 4: Moving in With In-Laws

This was the best option financially and looking at how much money we could save a month was just unbelievable.

The Catch: My in-laws lived in the middle of the desert over an hour away from the city, our lives, and major facilities.

The Bonus: My in-laws were retired, which meant NO daycare, giving us an extra $2500 per month or $30,000 extra per year alone in daycare savings, WHICH WAS HUGE.

4. Bye Bye House

Well, if you’re wondering which option we decided to go with, we were actually going to live with my in-laws for one year to pay off all our debt, then a year with my parents so we can get a sense of lifestyle back.

But then something happened: I developed a spinal leak from a medical procedure, which forced us to extend our time with our in-laws for help with the children, and we’ve been here ever since.

My paycheck was cut by at least 40% as I switched to disability, but we rented out our house as the rental market skyrocketed, which allowed us to offset the loss a bit by making a small profit off our home.

5. Hello Middle of Nowhere

Now, when we calculated living with my in-laws, here’s the areas where we expected to save money:

- Daycare: $2500 per month

- House & Bills: $2700 per month

Based on this, we figured it would take us right around a year to pay off all our debt.

But, there were SO many more savings we didn’t count on. We live in a VERY small town on the outskirts of the big city, where there is only one grocery store, one Walmart, and maybe two fast food chains and three restaurants. We don’t even have a drive-through Starbucks or Uber. So here’s some surprising savings:

- Food budget went from about $2000 a month to $1000.

- No home meant no home improvement projects.

- My in-laws wouldn’t let us pay for any typical living bills like internet, water, or electric until we paid off all debt, then we could contribute (absolute angels).

- Weekends were spent at friends’ houses in the backyards rather than meeting at costly outings or restaurants.

So in the end, we could essentially put our entire monthly earnings towards our debt.

6. Determining the Order of Debt Pay-Off

We were saving both incomes with extra profit from our house, and only spending around $1000 to live.

Now, I’ve read so much advice on which order you should pay off your debt. Paying off the highest interest was the best move financially. Paying off the smallest loan and working your way up via the “snowball” effect is another smart move. But honestly, none of those were a perfect fit for me.

I wanted more money open every month to attack the “big” renovation loan. So we paid off our car first, because it was a large monthly payment of $650 a month and we knew we could pay it off in less than two months. Once we did that, we then used it all to attack the renovation loan.

Then we did the credit cards last, as it was very easy once the two large monthly payments loans were paid off.

7. What We Learned Paying off $70,000 of Debt in 7 Months

Thanks to some extra income that came in like a work bonus and tax refund, we were able to pay off all of the $70,000 of debt in about 7 months.

Now, I’m not saying it was easy to move out of my home with children, with my husband driving an hour commute each way. Not to mention, weekend trips are exhausting on our kids when it takes over an hour, sometimes two, to get anywhere.

But we gained so much more than we ever expected. First off, this has been such a special time for the grandparents and the grandchildren, time we never would have had and will talk about for years. Secondly, we spend a lot of quality time as a family, movie nights, and are much less tempted to go out so much.

Looking Forward

Now that we’ve paid everything off, we look at money so differently. Here’s some things we do differently:

- Pay Cash For Big Items: We never want a couch or a car payment again. When I was growing up, my parents bought a house but couldn’t afford blinds (and we all know how EXPENSIVE those can be). As they owned a pizza shop, we had pizza boxes lining all the windows for two years until they could afford nice blinds. We lived on hand-me-down furniture until they saved up for a nice set. These are lessons we want to continue. Currently, my husband and I have saved up to purchase in all cash a used, 10-year-old Prius to get my husband to and from work to save on gas. No more car payments for us.

- Intentional With Money: Now, I’m not one to say I’m going to live frugally forever, but we’re much more intentional with our money. For instance, we would rather drive a ten-year-old vehicle, but will gladly splurge on international flights and Disneyland trips.

- Have a Healthy Savings: For the first time, we actually have the “six months of emergency funds” saved up. And it’s a great peace of mind.

- Prepared to Live Off One Income: As I mentioned before, I unfortunately suffer from a spinal CSF leak and there’s a possibility I may be permanently disabled. We are now in a place where we can comfortably live off my husband’s income alone without the added stress.

- Start New Business Ventures: The financial freedom allows us to look at starting new business ventures, which we wouldn’t have had the money to be able to do in the past. During the beginning months of starting a business, we’ve been very deliberate with spending money and have opted for things like a free digital business card instead of purchasing physical ones.

- Investing for Early Retirement: We can finally start contributing to Roth IRA’s, index funds, real estate, and have a plan in place to hopefully retire a little bit early in our 50’s while still enjoying our time while we’re young.

My Tips For Anyone Looking to Pay Off Debt

After going through all the ups and downs over the past year, here’s my not-so-popular opinions on paying off debt.

- “Skip the Starbucks and Brew Coffee At Home” is not great advice.

If you have significant debt, skipping all the coffee in the world won’t make huge strides to pay it off, just ruin your morning and you’ll quit before you’ve even begun. Like we saw above, living frugally for five years was an option for us, but we would be miserable for a very long time.

- Determine your true budget, then create different scenarios.

When you look at the reality in pay-off timelines between different scenarios, it’s a huge realization moment, but you can choose a scenario that’s best for you. Maybe it’s not as dramatic as mine was, but I’m a person that has an “all or nothing” attitude and I like to pay things off fast. I’m not good at minimizing my spending and would rather work extra.

But if you’re someone that can choose a more middle-of-the-road path that maybe isn’t the “quickest” way to pay off your debt, but one you can stick to, then do that!

- Remember, it’s never too late.

Don’t push to tomorrow what you can do today. No one can make the plan and attack the debt for you, it’s up to you to make that decision.

- Create a “Future Budget”, not just a “Current Budget”.

Whether you still have debt or have paid it off, make sure you continue to update your budget, and always calculate a “future budget” to make sure you’re on track.

We recently made our future budget and added in the costs of dance classes, soccer games, family vacations, and even cell phones with higher monthly bills when the kids become teenagers. That way, we have a good understanding of how our costs will go up and are preparing for it.

- Keep Living

From someone that went through a recent medical injury and currently has to lay flat about 85% of the day, remember to still make time for the things that bring you joy. Time is not a guarantee, so I would hate for someone to stop living while they were trying to get financially ahead, to then lose everything that ever mattered.

So always remember while you’re busy trying to meet your financial goals and get ahead, that life is happening now. Health is the ultimate wealth.

Author bio: Samantha Brandon is a pharmacist, spinal CSF leaker, and mother of two toddlers who is passionate about passive income and the FIRE revolution. She writes for women and mother entrepreneurs on her site at SamanthaBrandon.com.

Do you have debt? What are you doing to pay off your debt? Please share in the comments below.